In every season of generosity, God invites us to be stewards of His abundance — not only for today, but for generations to come. A Donor Advised Fund (DAF) is one way Catholic families and individuals are answering that call. Rooted in gratitude and guided by faith, a DAF allows you to give with intention, support the Church’s mission, and respond to needs as they arise — all while keeping your giving aligned with Catholic values. For many givers, a DAF is a perfect way to give today in order to protect the legacy they've always desired.

“As each has received a gift, use it to serve one another, as good stewards of God’s varied grace.” — 1 Peter 4:10

Put Into Practice: What is a Donor Advised Fund?

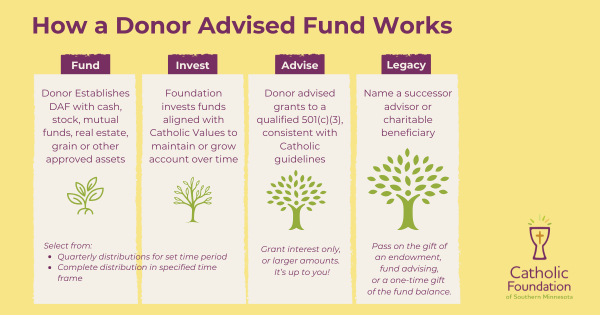

A DAF is a charitable account held by a Catholic foundation. You make an irrevocable gift, receive an immediate tax deduction, and then recommend grants to qualified charities over time. At the Foundation we care for the investments and ensures all grants align with Catholic social teaching and IRS guidelines.

How It Actually Works

Why Catholic Foundations?

Unlike commercial DAF sponsors, Catholic foundations offer:

- Faith-aligned investing: Assets are screened to reflect Catholic values. We have 0% direct conflict of interest among our $45M+ in managed funds because we proactively invest in alignment with USCCB Catholic Responsible Investing guidelines.

- Mission-driven grantmaking: Grants support ministries, parishes, schools, and charities consistent with Church teaching. In our last fiscal year we granted nearly 400 individual grants to Catholics in Southern Minnesota! Be a part of something big!

- Local expertise: Foundation staff can recommend impactful Catholic organizations right here in Southern Minnesota.

- Legacy planning: You can name fund advisor successors or designate Catholic beneficiaries to continue your giving.

Practical Giving Ideas: Real Ways to Use Your DAF

Here are examples of how Catholic donors are using DAFs to make a difference:

1. Support Vocations with Annual Seminary Grants

A donor sets up a DAF to fund scholarships for seminarians in the Diocese of Winona–Rochester. Each year, they recommend a grant to the diocesan vocations office or the Immaculate Heart of Mary Seminary, ensuring consistent support for future priests.

2. Back Parish Capital Campaigns Over Time

Instead of a one-time gift, a donor uses their DAF to recommend multi-year grants to their parish’s building fund. This allows them to grow their gift over time without capital gains taxes. Or, pace their giving and while maximizing tax benefits of giving to a DAF over multiple years.

3. Engage the Next Generation In the Legacy

A family opens a DAF and invites their children to help choose annual grant recipients. Together, they support Catholic schools, food shelves, and pro-life ministries — building a legacy of shared values and generosity.

4. Respond to Urgent Needs

When a Catholic hospital launches an emergency appeal, a donor recommends a grant from their DAF within days. The Foundation handles the compliance and distribution, allowing the donor to act quickly and faithfully.

5. Honor a Loved One’s Memory

A donor creates a named DAF in memory of a parent who loved the Church. Each year, they recommend grants to causes that reflect that legacy — from parish music programs to Catholic Charities.

Common Reasons People Consider DAFs

- They wish to move ownership of funds out of their name, but still leave the legacy they desire

- They are interested in directing the use of the funds in theshort or long term

- They want their designated charities to receive the benefits of high investment returns without tax implications

- They are looking for an immediate tax write off

How We Help with DAFs

- We make transferring funds or stock easy and can work directly with your broker or financial advisor

- We can help you weigh the pros and cons of an endowed gift vs Donor advised fund

- We can help you figure out a distribution strategy, such as what percentage to give each year so that the gift lasts a certain length of time

- We do the work to distribute your gift to your Catholic charity of choice, like cutting and mailing the check

What to Know Before You Open a DAF

You'll need to be sure to speak with your tax advisor and attorney for tax and legal implications specific to your situation. For instance the charitable gift amount you can deduct may depend upon your AGI and recent tax law. For our part, we've created some guidelines to help keep things as frictionless as possible for everyone.

Minimum funding to open account:

- Cash - $5,000

- Securities or grain - $10,000

- Real Estate - $200,000

- Other assets can be discussed with your Foundation representative

Maximum grant frequency by account balance:

- <$50,000 - 1 annual grant distribution

- $50K+ - quarterly grant distributions

- $2M+ - quarterly + 2 ad hoc distributions

Distributions may be requested by:

- Complete, sign & mail or email in a simple form

- Visit the Granting page on our website and complete the form there

Successor Options:

- Name a new individual fund advisor to take over at your passing

- Name a beneficiary to receive the gift (e.g. St. John's Parish)

Grant Restrictions:

- 401(c)(3)

- Catholic organization

Ready to Begin?

Reach out to our Executive Director today to talk about your giving goals to help create the right type of fund to create the legacy you desire and support your current tax goals. Ask about investment options, grant turnaround times, and how your giving can support the Church’s mission in Southern Minnesota and beyond.

Elizabeth Williams, ewilliams@catholicfsmn.org, 507-218-4098