Cemeteries are not only places of memory and rest—they're enduring witnesses to community faith and continuity. Stewarding their financial resources requires prudent planning and tiered investment strategies that ensure both short-term stability and long-term sustainability. As I’ve met cemetery directors, pastors, bookkeepers and secretaries, the passion for permanent care of these sacred spaces is impressive to say the least. It made me think, how can we at the Foundation use the investment expertise we have to help these folks who are working night and day serving in Corporal Work of Mercy?

I had a discussion Andrew Brannon, DOW-R CFO; and our Foundation investment advisor, Brad Stephan from Concord Advisories regarding the challenges cemeteries have and how we could help. While more cemeteries are comfortable with knowing the right amount of permanent care funds they need to preserve them into the future (see chart far below from Larry Dose’s calculation formula), we noticed that where to hold those funds to best serve the cemetery’s interests held some inconsistencies. So, I thought, why not put all of this wisdom together and come up with some best practices!

Before I share the best practices, I want to make sure it’s clear that these are guidelines – not rules to be followed. Every cemetery is unique, so you’ll want to create your unique investing plan around your unique situation.

Considerations

First, in my conversations with the trusted leaders mentioned, we identified 5 common categories of funds that cemeteries often have so we mapped accounts to each category:

- Same year operating expenses

- Immediate capital expenses - above & beyond normal operating

- Near term (1-3 years) capital expenses

- Long-term savings - permanent care restricted or other savings

- Endowments

Then, we talked about the types of accounts that work best and common considerations we hear:

- We’ve noticed people like to work with their local banks so that they can keep business local. We incorporated local banks where it best serves the cemetery’s interest.

- We understand convenience is important – cemetery directors don’t need the extra headache of requesting funds frequently or renewing CDs every six months. We took that into consideration: Here at the Foundation you can take out money at any time without a fee including scheduling transfers of funds in advance.

- We know protecting against inflation is critical – these funds need to care for the cemetery in perpetuity, so an investment strategy needs to not only keep up with inflation but grow beyond that to maintain an operating budget each year.

- It is mandated by the US Council of Bishops that following Catholic Responsible Investing (CRI) is important. Following CRI reflects our Catholic mission to honor life, dignity, and creation. It’s about stewardship with conscience—serving both the living and the departed with integrity.

- What else are we missing? I welcome you to send me an email if you have other considerations for why you choose an investment strategy! ewilliams@catholicfsmn.org

With all of this in mind, the following best practices outline a structured approach to where to place funds, helping cemeteries honor their responsibilities with clarity and foresight.

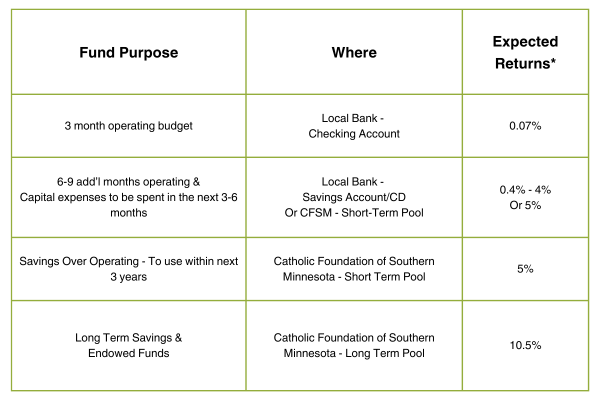

Best Practice Placement by Fund Purpose

* Assumptions made for expected returns

- 0.07% is a rough average of current checking account interest rates.

- 0.4% is a rough average of current savings account interest rates; 4% is the higher end of CD rates we’ve heard people are getting today locally.

- 5.02% is the average return net of (after) fees from our short-term (or lower risk) pool with the Catholic Foundation of So MN in the past 5 years (6/30/25). In fiscal year 2025 (Jul ‘24 - Jun ‘25), we saw 8.74% net of fees.

- 10.5% is the average return net of fees from our long-term (or higher risk) pool with the Catholic Foundation of So MN in the past 5 years (6/30/25). In fiscal year 2025, we saw 13.42% net of fees.

What do you think?

No two cemeteries are the same. No two boards, trustees or cemetery directors are the same either, so this might not fit you exactly. I’d love to hear what you think. What mix of accounts are working for you? How can we help further? Reach out today. 507-218-4098, ewilliams@catholicfsmn.org